Upload Paycheck Picture and Deposit to Chase Account

Mobile Bank check Eolith

Mobile Bank check Eolith

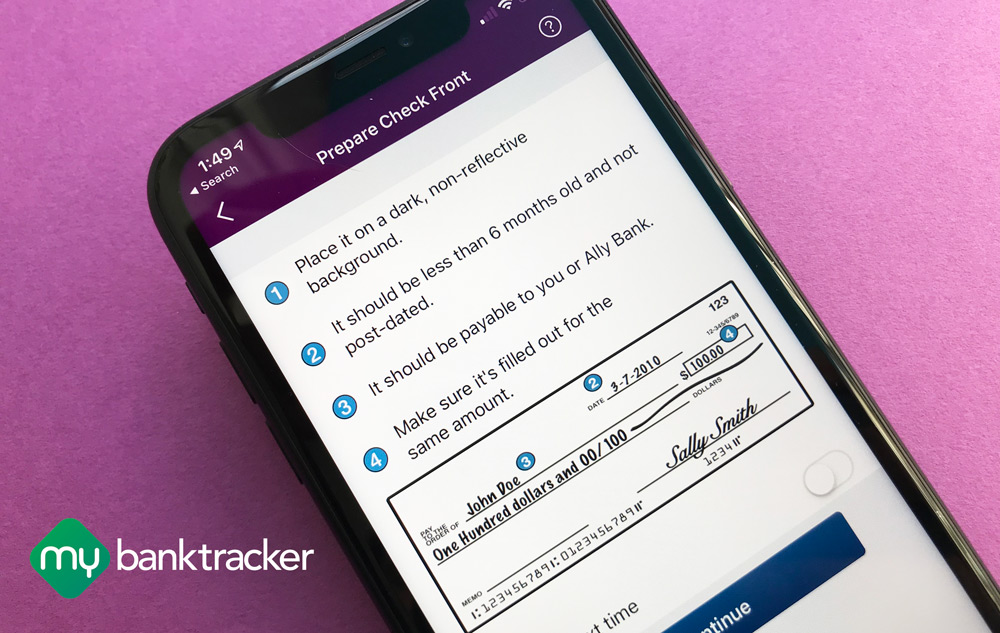

Mobile bank check deposit, which lets y'all deposit checks by taking photos of them, has become 1 of the highly demanded features of mobile banking -- you might even want to switch banks to get information technology.

Only, the deposit limits on this feature may sway the choice of the bank.

Different check deposits through a depository financial institution teller or ATM, mobile check deposits are subject to limits because of the heightened run a risk of check fraud.

Since customers tin can still hold onto a check after it is deposited through a smartphone, it is possible that someone may endeavour to eolith the aforementioned bank check at multiple banks.

If yous take to eolith checks in excess of these limits will have to resort to visiting a co-operative or ATM. These limits may also affect your determination of picking the best checking business relationship for you.

Mobile Check Deposit Limits at the Top U.Due south. Banks

Bank of America

The Bank of America mobile cheque deposit limit are $10,000 per month for accounts opened for 3 months or longer; for accounts opened for fewer than three months, the limit is $ii,500 per month.

For customers in the Bank of America Preferred Rewards program for more than than 3 months, the mobile check deposit limit is $50,000 per month. For accounts in the program for fewer than 3 months, the limit is $25,000 per month.

Chase

The Chase mobile bank check deposit limit for all customers is $2,000 per solar day and $5,000 over a thirty-day menstruation.

Wells Fargo

The Wells Fargo mobile check deposit limit for all customers is $two,500 per mean solar day and $five,000 over a 30-twenty-four hours menstruation.

Citibank

The Citibank mobile check deposit limit for customers with accounts opened for 6 months or longer is $1,000 per day and $3,000 per month; for customers with accounts opened for fewer than half dozen months, the limit is $500 per day and $1,500 per month.

U.Due south. Depository financial institution

The U.S. Banking concern mobile check deposit limit for personal accounts varies from $500 to $two,500 per 24-hour interval, depending on the business relationship relationship.

Upper-case letter I

The Capital One mobile bank check deposit limit varies for each customer account. According to Capital One branch banker, the typical limit is $5,000 per day.

PNC Bank

The PNC Bank mobile cheque deposit limits for customers with accounts opened for thirty days or longer is$2,500 per 24-hour interval and $5,000 per month; for customers with accounts opened for fewer than 30 days, the limit is$ane,000 per day and $ii,500 per month.

TD Depository financial institution

The TD Bank mobile bank check deposit limit for customers with accounts opened for 3 to 6 months is$1,000 per solar day and $two,500 per rolling thirty-24-hour interval menses; for customers with accounts opened for vi to 12 months, the limit is $2,500 per day and $3,500 per rolling 30-solar day menstruum; for customers with accounts opened for more than 1 twelvemonth, the limit is $2,500 per day and $6,000 per rolling 30-day period.

SunTrust Bank

The SunTrust Bank mobile cheque deposit limit for customers with accounts opened for 6 months or less is$i,000 per check and $v,000 per month; for customers with accounts opened for more than half dozen months, the limit is$8,000 per calendar month.

For SunTrust private clients, the mobile cheque eolith limit is $25,000 per month.

BB&T

The BB&T mobile check eolith limits for accounts opened for less than 90 days is$500 per twenty-four hours and $ane,000 per 30-day menses; for accounts opened for at least xc days, the limit is$two,500 per twenty-four hour period and $five,000 per thirty-day period.

For BB&T wealth direction clients, the mobile cheque deposit limit is$25,000 per month.

Online Banks For Higher Limits From The Start

Online banks don't operate large branch or ATM networks. Therefore, online-banking company customers tend to rely heavily on mobile banking and mobile check deposits to manage their accounts and deposit checks.

If limits are besides depression, these customers would have to worry when they receive larger checks.

Luckily, many online banks understand this business organization and offer higher mobile deposit limits compared to banks that have a physical presence.

See the mobile deposit limits of some of largest online banks:

Mobile Deposit Limits - Online Banks

| Online bank | Mobile deposit limit(s) |

|---|---|

| Capital 1 360 | $v,000 or 20 checks per twenty-four hours or $ten,000 per calendar month |

| Ally Depository financial institution | $50,000 per day or $250,000 in a 30-day period |

| Banking concern of Net | $x,000 per day or $50,000 per xxx-day period |

| TIAA Direct | $30,000 per twenty-four hour period or up to 6 checks per twenty-four hour period |

| PayPal | $5,000 per twenty-four hours or $10,000 per month |

Annotation that many online banks volition accept check deposits through the mail if you ever exceed their mobile bank check deposit limits.

Mobile Deposit Limits Can Always Change and Differ Past Account

Information technology is important to note the actual mobile eolith limits on your accounts can vary from the limits above.

Nearly banks reserve the right to modify these limits for whatever reason. The factors may include account age, relationship status, activity, and account balances.

If you've made several attempts to deposit bad checks, your bank may decrease your mobile eolith limit and force yous to visit a branch or an ATM.

In the worst-example scenario:

You might fifty-fifty lose your mobile deposit privileges.

Customers who have several accounts with the bank and maintain larger balances could be eligible for higher mobile eolith limits.

If you are using the feature regularly, your bank may increase your personal limits gradually.

Deposit your large checks using a telephone with these top online banks:

counselolstoord93.blogspot.com

Source: https://www.mybanktracker.com/news/comparing-mobile-check-deposit-limits

0 Response to "Upload Paycheck Picture and Deposit to Chase Account"

Post a Comment